China – The Powerhouse Economy

China is the fastest growing economy in the world, and a gold mine for Western brands. China’s GDP is expected to grow by 6% in 2019, that’s equal to adding the entire Australian economy to their 2018 GDP. Along with this, they are becoming more consumption-driven than ever; China contains over 1.3 billion consumers, with a rapidly growing middle class that has more spending power than any other.

- IDC estimates that the Chinese grocery market is expected to grow annually by nearly 6%.

- In 2018, China’s online B2C sales grew 31% year on year to 5 trillion RMB ($747 billion, €670 billion), according to the research firm Analysys China.

- For the first half of 2019, China’s total online sales surged 17.8% year-on-year.

- During the recent Golden Week (from October 1-7), retail and catering businesses in China saw sales of $213 billion, up 8.5% on the same period last year.

- China represents a third of the world’s total luxury consumption, a figure that’s expected to increase to over 40% by 2025, according to McKinsey.

The problem is that while many companies have tried to expand into China, most have struggled or outright failed.

Western companies looking to expand their business generally underestimate the competitiveness of the Chinese market. Often, what stands in the way of success is a lack of understanding on what Chinese consumers value and how they shop. Chinese consumer’s demands are unique, and companies who simply replicate Western business models and marketing strategies are almost destined to lose.

On the other hand, there are some that have done their research, made local partnerships, made necessary changes, and earned the rewards. We will go through 12 important lessons that your brand should keep in mind. On top of that, we’ve also compiled a list of 6 brand case studies so that you can see firsthand what makes or breaks a Chinese marketing strategy.

What Your Brand Should Avoid

1. Lack of research

In 2009, Mattel opened a Barbie store in Shanghai, but quickly failed due to them not realising Chinese tastes are very different from the West. In China, Barbie was marketed as ‘sexy’, when it should have been marketed as ‘cute’ (e.g. Hello Kitty).

Another example is when Unilever tried to introduce its Rexona deodarant into China. This was ignored by Chinese consumers, because they do not have Westerners’ body odour issues, and don’t perceive sweating as something bad; since it cleanses the body.

P&G’s initial introduction of the Pampers brand was a flop. In 1997 it introduced a cheaper version of their ‘Western’ product, assuming that parents would simply buy them if they were cheap enough. But Chinese parents had no use for them. Instead, Chinese children typically wore a ‘kaidangku‘, a open-crotch pants that allows kids to relieve themselves quickly. The cheap Pampers were perceived as ‘irritating plastic‘.

Takeaway: Chinese culture is vastly different from the West, and so are the consumers within. It’s important to find out what your target audience will respond to, and not to simply replicate something that worked in the West.

2. Inappropriate adaptation

Victoria’s Secret tried to woo consumers at a 2016 Fashion Show by having models strut down the walkway in tacky dragon-themed outfits. Instead of approval, they were called ‘racist’ by the audience.

Similarly, Dolce & Gabbana dressed out its models in a stereotypical Chinese fashion as a kind of tribute to the culture. Instead, it was seen as a mockery. One person in attendance commented that the fashion style feels icky, and represents an outdated and stereotypical view of Asian culture.

Takeaway: Gone are the days when brands could slap a dragon on a product and have it sell out in China from brand reputation alone. It’s important to remember that Chinese consumers won’t just buy anything — they are highly selective and discerning.

3. Translation Issues

Mr Muscle suffered a translation crisis when it was first sent to China, with many native speakers noting that it sounded like “Mr Chicken Meat”.

Similarly, earlier imports of Coca-Cola without modern advertising practices led to many odd Chinese interpretations of the name, including one version that translated literally to “Bit the Wax Tadpole”.

Coca-Cola’s competitor Pepsi introduced their slogan “Come alive with the Pepsi Generation” into the Chinese market, but it was not properly translated — and as such, was read as “Pepsi brings your ancestors back from the grave”.

Takeaway: What sounds great in your home country, may be regarded as weird or even offensive in China if translated carelessly. This makes having a proper translation team that can convey the story and meaning behind your brand’s words crucial.

4. Outclassed by local competition

When Google was introduced in China in 2006, it fought a head-to-head battle with Chinese search engine Baidu. Baidu invested heavily on internet cafés, which most Chinese consumers used to get online in the 2000s. It paid the cafés a fee to have Baidu installed on the homepages for high visibility, basically becoming the norm, in China.

Another example is Airbnb. When they entered China, they were easily the biggest in the industry. However, they were quickly overtaken by Tuija, which was much more adaptive to the Chinese market. Tuija partnered with real estate developers to rent empty houses, then function as intermediaries to rent the houses out, without the need of the home owners to do anything. Tuija did the cleaning, door lock installation and even helped with the furniture.

Takeaway: Since China is a big market, local brands are able to grow to a much larger scale, increasing their ability to take on multinational brands. So the question is, what does your brand have that will separate it from the dozens of cheaper more familiar Chinese alternatives?

5. Not using digital-focused campaigns

It is no longer the LV bag that gives prestige, instead it is about showing off your exotic trips abroad on WeChat or Weibo. A must is social media campaigns. In 2015, foreign companies only spent about 3-6% of their marketing budgets on digital in China, according to Shaun Rein from China Market Research Group (CMR).

Which this figure has increased over the past few years, it pales compared to China, where almost 83% of companies and employees use WeChat for work-related purposes.

Takeaway: Too many foreign businesses are self-sabotaging their chances of success in China by not giving more thought to social media. In comparison, Chinese local competitors will already have established WeChat and Weibo accounts in which people are encouraged to follow and interact with.

6. Poor positioning of price-value

In China, Walmart has been losing market share by keeping their big-store model while trying to maintain the same ‘average-cheap’ pricing in the West, rather than appropriately scaling to the market by selling higher-margin products. Wealthy consumers in China don’t want more cheap goods – they are often on the lookout for specialty items.

This is also seen in the case of Marks & Spencer, where their products were too ‘average’ for Chinese consumers. Shaun Rein (Chinese Market Research Group) says: “Anything that’s not great value – it doesn’t give them prestige, it doesn’t give them status, it’s not an aspiration – is something that Chinese don’t want unless it’s dirt cheap. So they’ll go out and buy very expensive lipstick but they’ll buy the cheapest garbage bags because they don’t want to spend money on garbage bags.”

Takeaway: Products like those that Marks & Spencer offer, fall short and are ignored by Chinese consumers because they are positioned in the middle. They are not cheap, but they’re not good enough value either for most consumers to consider.

What Your Brand Should Do

1. Lifestyle fit over price

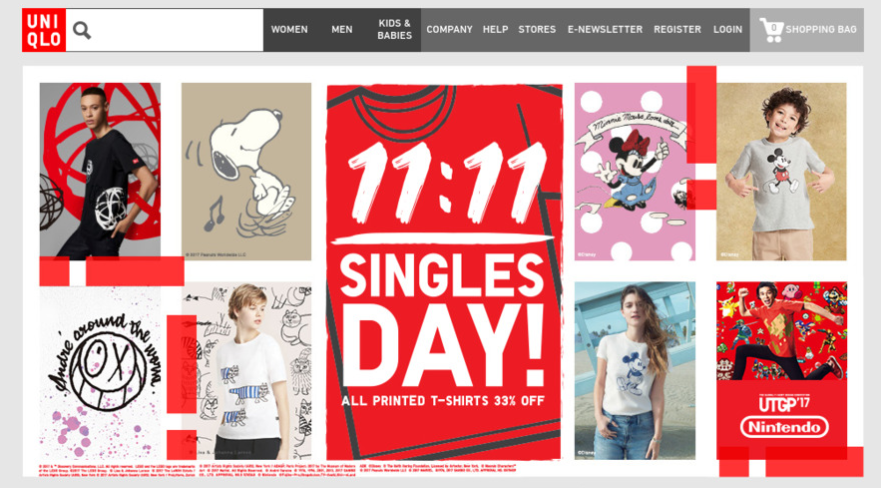

In China, sophisticated consumers are looking beyond price and quality and identify more strongly with brands that fit in with their lifestyle. Uniqlo is one brand that Chinese consumers are finding to be a great lifestyle fit. In 2018, Uniqlo was crowned the top seller during Taobao’s ‘Double-11’ shopping festival in both the men’s and women’s clothing categories, earning CNY100 million (Chinese yuan) of sales in just 35 seconds.

Uniqlo is well known in China for its high-quality basic clothing, but it is Uniqlo’s approach in creating innovative products for any occasion that has been the key to winning over Chinese consumers. By creating versatile and high-quality apparel that integrates seamlessly into the everyday lives of its customers, Uniqlo has been able to gain a foothold in China.

Takeaway: Chinese consumers are willing to pay for high-quality essentials that integrate into their everyday lives. Quality, pricing and prestige will gradually be surpassed by how seamlessly the product’s design and function fits into the consumer’s life.

2. Tailored approach

Though pampers was initially a flop, it eventually announced a new product in China named ‘Pampers Cloth Like & Dry’ with more fabric and less plastic. Sales then skyrocketed when they launched the ‘Golden Sleep’ campaign, claiming babies sleep better in diapers which could be better for their cognitive development — which Chinese parents were highly receptive to.

When KFC entered China, it added to its menu egg tarts, soy milk drinks, fried dough sticks and congee. But when Shanghainese customers found their food too spicy, and Sichuan found it too dull, KFC saw success in offering different levels of spiciness across the country. KFC now has over 5000 restaurants in 1100 cities and over 30% of market share (while McDonald’s sits at 15%).

Takeaway: Succeeding in China’s market shouldn’t just be about ‘delivering value and offering amazing products’, because that should be a given for any market. It’s far more important to figure out how you can tailor your approach in a way that differentiates your brand and makes Chinese consumers remember you over the next half-dozen competitors.

3. High product visibility

Unilever’s Rexona was at a disadvantage from the moment it launched, as showing off is difficult to do with products that nobody can see.

Chinese consumers are extremely brand literate and brands like Apple, Chanel and Starbucks are popular as they cater to Chinese who love to show they’ve made it. Both Apple and Starbucks stores are in highly visible and high-traffic locations. Showing off is so important that some Chinese prefer sitting in a traffic jam every day, just to show they own a BMW.

Takeaway: Brands that provide products in which consumers are able to show off will be more valuable than things that nobody can see. Sell your customers something they will be proud to wear, show off and tell their peers about.

4. Local partnerships

To get a grip on China, Starbucks partnered with local coffee chains, such as Mei Da from Beijing, Uni-President from Taiwan and Maxim’s Caterers from Hong Kong — which led to opening more than 3400 stores in China. Thanks to the local partnerships, Starbucks plans to open another 2000 before 2020 — furthermore, it has helped provide almost 50,000 employees.

Upon entering China, Proctor & Gamble partnered with the Hutchison Whampao company from Hong Kong as well as Guangzhou Soup Factory, effectively setting up infrastructure and launching one brand after another (starting with Head & Shoulders and Crest toothpaste). Today, P&G brands Rejoice, Safeguard, Olay, Tide, Gillette and even Pampers are the top brands in their categories.

Takeaway: Instead of trying to force their way through the countless number of local competitors, these brands handpicked partnerships to help them get off the ground. Starting your business in China is a difficult venture, and having local partnerships will make the journey easier and save costs.

5. Business transparency

Nong Fu Spring, a mineral water and fresh produce brand launched their ‘17.5° digitally traceable orange’, which allowed consumers to scan a QR code in order to find out where their orange comes from, how it was grown, its growing process, and other details regarding its quality. Thanks to transparency building confidence among consumers, these oranges sell incredibly well on the Chinese e-commerce marketplace — despite it costing double the price of similar brands of oranges that originate from the same region.

Consumers who scanned the QR code gained a more positive impression of the 17.5° brand. Openness around the production process, area of origin and even the name of the supervisor in charge of cultivating the fruit demonstrates to customers that the company is committed to transparency and accountability. By making this information easily available, a relationship of trust can be maintained between company and consumer.

Takeaway: In order to build trust, companies should be open about providing the information customers want about their products.

6. Choosing the right KOLs

Chinese marketing advice is never complete without the mention of KOLs. Key Opinion Leaders (KOL) have an incredibly powerful promotional impact, which are beneficial to foreign brands at any stage of the journey, whether a brand is starting out (draw attention, bring an obscure brand into the spotlight), or already established (overcome plateaus and bring in new buyers).

Iconic British car brand Mini collaborated with Chinese KOL Becky Li to promote a limited edition vehicle through WeChat. In just five minutes, 100 of these limited edition cars were sold. New Zealand’s Richora Honey, a New Zealand brand, was promoted on live streamer Viya’s stream, which led to 377,000 units of their products being sold in hours – in the first 5 seconds, 10,000 units sold. During Alipay’s 12.12 “Shopping Holiday”, Taobao invited famous KOL Ms Yeah (办公室小野) to do a series of short video programs in which she interviewed eight different KOLs and recommended various products to the audience. The videos have been played more than 200 million times and the program’s hashtag on Weibo got mentioned more than 100 million times.

Takeaway: KOLs are extremely powerful, and are instrumental in most China marketing campaigns. A KOL can help you reach your ideal audience, generate sales, and boost your brand’s image in China. Even if the KOL is not directly selling the product, they are heavily influencing purchasing decisions.

6 Brand Case Studies to Study

While having a comprehensive list of hits and misses is valuable, it’s even more useful to have actual case studies to study from. We have compiled a list of six brands and what made or break their position in China.

Tesco: Failed Market Research and Timing

Tesco first launched into China in 2004, but failed in enticing Chinese shoppers through its doors. After trying to capture the market through a failed Clubcard system, and then failing in its attempts to localise, Tesco relinquished control of its stores to a local competitor.

In-depth breakdown

Tesco launched in 2004, rolling out massive stores very quickly and relying on their ‘secret weapon’ Clubcard to drive in sales. Despite the Clubcard being incredibly popular in the UK, Chinese shoppers did not care one bit, as they typically carry an average of four loyalty shopper cards already — which they habitually cycled through for the best deals. Tesco’s Clubcard didn’t offer anything new or groundbreaking that Chinese shoppers didn’t already have access to.

After, Tesco tried to backtrack through appealing to China’s grocery culture, by selling live toads and turtles. However, even this was not enough.

Kunal Kothari, an equity analyst at Old Mutual Global Investors, believes another main factors behind Tesco’s failure in China is that it launched relatively late in 2004, behind rivals such as Wal-Mart, which were able to use their first mover advantage to pick better and lower-cost store locations.

Maureen Hinton, group research director at Conlumino, a retail consultancy, agrees that the two main reasons for Tesco’s failure in China was insufficient market research, and timing. “It was up against strong competition from well-known local brands in the best locations, with established relationships with suppliers and a thorough understanding of the Chinese consumer’s buying habits, as well as a rapid take-up by consumers of online shopping,” she says.

Why did Tesco fail?

- Cultural differences: Tesco’s market research did not focus enough on accommodating to cultural differences. Instead, the company attempted to replicate it’s UK model, which China did not care for. This meant that Tesco’s later attempts to localise its stores and appeal to Chinese grocery culture through selling live toads and turtles was already implemented too late and did not drive sales high enough to bring Tesco back.

- Not adapting their strategy: Tesco’s secret weapon, the club card, was vastly successful in the UK. As a result, Tesco relied heavily on this method for finding success in China. Unfortunately, Chinese consumers already carry a variety of loyalty shopper cards, all of which offered much more convenience than Tesco’s — which required customers to go out of their way to a Tesco store.

- Launched too late: Tesco launched in China after the momentum for foreign retail chains was dying down. According to Old Mutual Global Investors, other foreign retailers had expanded into China (including Walmart) right before Tesco had—which took away any momentum and removed the first-mover advantage. After Tesco arrived, Chinese consumers weren’t particularly compelled to shop there for its novelty—because other companies had already taken that advantage. In fact, 63% of Chinese shoppers have been polled to carry multiple loyalty shopper cards.

Amazon: Inability to Adapt & Tailor

Amazon’s launch into China was initially quite successful, but from a combination of factors like struggling to compete with local competitors and not adapting well enough to Chinese consumer demands, Amazon’s market share plummeted to less than 1%.

In-depth breakdown

Amazon started off strong in China, having purchased the local online book e-tailer Joyo.com, granting it early entry and a dominant position to kickoff from. In no time, Amazon established a market share of 15% which was nothing to scoff at. Over the years however, Amazon began struggling against the local e-commerce competition, most notably Tmall and JD.com. The company fell short against its competition in large part because it refused to match the offerings of local competitors: free shipping and overnight delivery.

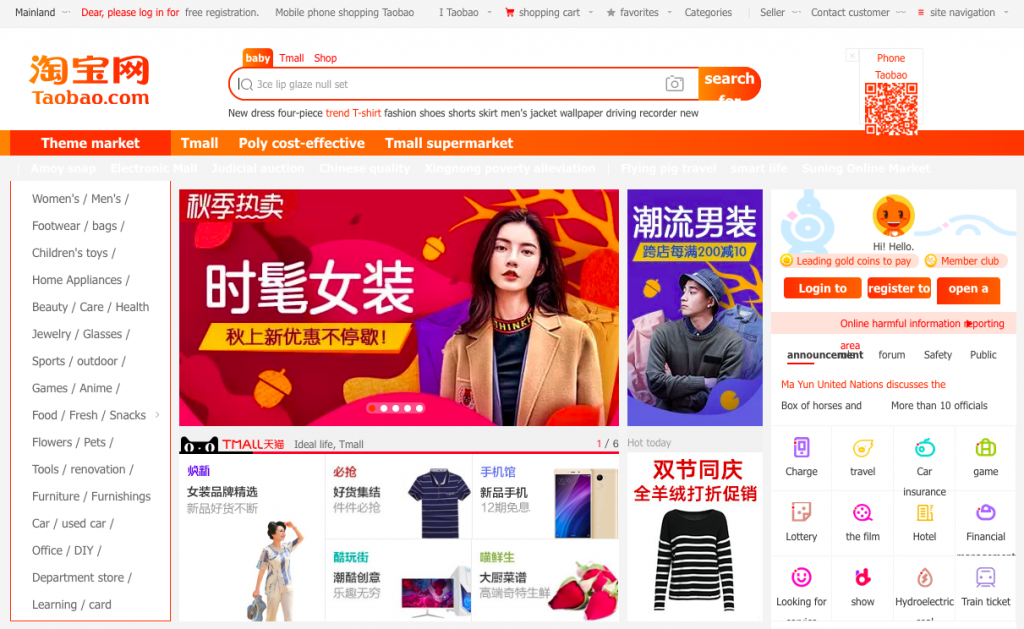

When Amazon announced it would cease operations in China, Chinese consumers were hardly surprised due to Amazon not adapting to the local market and preferences of Chinese consumers. This was most prominent in their website design. Chinese consumers prefer e-commerce sites that are colourful, vibrant, and make them excited to purchase by cramming in products, deals, and other things onto a single screen, something which Taobao and JD.com do very well. Amazon’s on the other hand, was too simple and minimalist. “Amazon’s UI is as s**t as Newegg’s,” someone wrote in a popular comment. “The moment I see it, I lose all desire to make a purchase.”

Amazon’s employees were also aware of how little appeal the site had in China. “American companies want to stick with just one UI style across the globe,” an unnamed source told China Business Journal. “But that makes customising the Chinese webpage very difficult.” Amazon’s Chinese site did see a lot of changes, according to the employee, but getting those changes done was difficult and took a long time. “That’s unlike China’s other 996 ecommerce companies,” they said. “In those companies, as soon as the boss requests a new feature, the staff burns the midnight oil until it’s launched.”

Finally in 2019, Amazon shuttered its e-commerce marketplace business in China this year — after more than 15 years of trying.

Why did Amazon fail?

Unable to match competition: Amazon needed to change the way it organised basic delivery, but just couldn’t bring itself to change the system they had already set across all their other countries. They did not grasp that in China, access, convenience, and especially speed, trump just about everything else including price. While local competitors offered fast and often free delivery on all purchases, Amazon locked theirs behind a minimum spend of anywhere from 59 yuan to 200 yuan ($8.79 to $29.81).

Unappealing website design: Amazon’s website design was too simple and neat, a far cry from the likes of Taobao and JD.com, which were exciting and colourful, and threw out over a dozen products for you to purchase from the first few seconds of opening the site. Amazon’s standard minimalist web design was so unappealing in fact, that it was turning users away from purchasing. Chinese consumers don’t have the same preferences as Western consumers — they are looking to buy and get down to business, and aren’t looking to admire how aesthetic a site is.

Fixes were implemented too slowly: Amazon’s final mistake that led to its decline over the years was them not implementing the necessary (and important) fixes quickly enough. Even after employees themselves became aware of how much distaste Chinese shoppers had for the site UI, Amazon took too long to make the changes. Compare this with local businesses in China, where employees are extremely work-oriented, and work until the job is done. This is highlighted especially well in the film documentary American Factory which showcases the contrast in work ethic, speed and quality between American vs Chinese factory workers.

Best Buy: Unjustified Pricing and Bloated Expenses

Best Buy opened in China in 2006, but suffered from piracy, cost-conscious customers and a bloated company cost structure, all of which contributed to its eventual failure. By 2011, Best Buy had to close down all nine branded stores in China.

In-depth breakdown

With its growing middle class and proximity to electronics manufacturers, China represented a huge growth opportunity for Best Buy. After studying the market for three years, Best Buy entered the Chinese market by buying a majority stake in Jiangsu Five Star Appliance – a local retailer – in 2006.

But the expected flood of customers failed to materialise. Instead, after struggling for six years, the company had a meager 1.8% market share — which led to its decision to close down all branded stores in 2011. The company’s problems in China stemmed from three main issues: piracy, cost-conscious customers and the unpopular big box retailer format.

China’s extensive manufacturing infrastructure made it easier for competitors to make counterfeit Best Buy products and sell them at a lower cost than the store.

The Chinese customer also turned out to very price-sensitive, and Best Buy’s products were far more expensive than that of its competitors. As Best Buy’s target audience was middle class, they needed to provide adequate justification for the premium prices of its products, but were unable to do so.

Ultimately though, it was Best Buy’s failure to work in the local retail format that negatively affected the company’s prospects on multiple levels. The firm’s bloated cost structure contributed to its expenses and was eventually reflected in product pricing. For example, the firm chose to own and manage operations for entire showrooms instead of renting out space to individual manufacturers like most Chinese retailers. Best Buy also replicated its store warranty model in China, where customers are more familiar with manufacturer warranties for products. The problem was that warranties cost extra, which further inflated product prices.

Why did Best Buy fail?

Cheaper counterfeit products: Rampant piracy in China meant local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers as these counterfeit products sell for cheaper.

Failing to justify price points: Critics are quick to blame Chinese consumers for being too ‘cheap’ to buy expensive products. However, it’s hardly fair to blame Chinese consumers for not wanting to pay a premium on products that they could buy elsewhere. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store? Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere. Local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity.

Bloated cost structure: Best Buy failed to capitalise on the opportunity of online sales; instead it focused on physical locations assuming that the country was not undergoing any evolution. This increased expenses and when compounded with the lack of customers, forced Best Buy to further inflate pricing — which only made matters worse.

Costco: Success Through Familiarity and Trust

Costco saw immense success, so much so that they had to shut down their first store from too much demand. This reaction was something that few Western retailers ever get to experience. This was in large part because of the trust and familiarity that Costco had with its Chinese consumers, having been selling to them from the US for quite some time before ever stepping foot in China.

In-depth breakdown

Costco launched its first store in China just this year. However, soon after opening the doors, Costco was forced to shut them, as crowds flooded the store eager to snatch up its discount offerings. This was thanks to extensive market research that spanned years.

Unlike Tesco, Costco actively tested its products on Chinese consumers long before ever opening a store in China. Five years ago, it began selling its signature Kirkland products on Tmall Global, Alibaba’s cross-border B2C platform designed to sell international products to Chinese consumers. Plus, on their Tmall store, consumers give it an average rating that was about 40% higher on customer service and other metrics than its comparable rivals in the industry.

All of these factors created familiarity between the Chinese and its brand, who came to view Costco and Kirkland’s lowest price and highest quality to be a compelling differentiator. By the time Costco announced it would open physical stores in China, the Costco brand already had a very strong and loyal following — thus leading to the overwhelming success of its launch.

How did Costco succeed?

Didn’t jump immediately into China: Thanks to Costco testing the waters with their overseas Chinese audience, they not only learnt what would work and what wouldn’t, but also were able to create a sense of familiarity.

Positive relationship with buyers: Thanks to the familiarity Costco had with Chinese shoppers, a positive relationship had already been built, which meant their success going forward was all but a done deal. Consumers in China couldn’t wait to see what other low price & high-quality products like Kirkland they would find at Costco stores.

Differentiate themselves from the crowd: “Just being the third or fourth store with items on the shelf, that’s not enough anymore. You have to have reasons for consumers to pick you over other options. To do that in a crowded and sophisticated marketplace, you have to have some sort of newness in the concept,” says Greg Portell, a retail consultant at A.T. Kearney.

Starbucks:

Starbucks is one of the biggest success stories of a Western brand in China. They started off in Beijing with everything stacked against them (tea was the common drink in China). Fast forward two decades, and Starbucks is a nationally recognised brand representative of wealth and affluence, and has its eyes set on 6000 stores in China.

In-depth breakdown

Starbucks entered China in 1999 during a time when understanding of coffee was limited to Nestle packets. However, somehow they managed to convince Chinese who had always loved tea, to drink coffee, and to pay lots of money for it. In fact, nowadays, people spend well over 50 RMB ($7) for a single cup of coffee, the equivalent of a huge family breakfast in China.

After opening the first store in Beijing (supported by a partnership with Beijing Meida Coffee Limited), Starbucks ventured into Hongkong and Shanghai in May, 2000. From there, they took advantage of partnerships with Taiwan Uni-President Enterprises and Hongkong Maxim’s Caterers Limited respectively, allowing them to open up stores in the CBD. From the very beginning, Starbucks positioned itself as an upmarket brand. It started the search for its first batch of customers in high-end shopping malls and office buildings.

Once Starbucks successfully associated itself with “high-end,” white-collars and businessmen started to associate Starbucks with business meetings and the high-class life. From there, the money started flowing in as China’s affluent flocked to Starbucks to buy a cup to show off their status.

To differentiate themselves from the local competition (or what remained of it), Starbucks offers their staff free coffee, free meals, and generous insurance coverage that most Chinese companies don’t offer. On top of this, they call their staff “partners”.

Starbucks now has more Starbucks stores in Shanghai than in New York. More than double to be precise. And they plan to venture into another 100 new cities of China, with the ultimate goal being 6,000 stores in China.

How did Starbucks succeed?

Leveraged local partnerships for faster launch: In order to hit the ground running, Starbucks made effective use of local companies to back their expansion. This allowed them to reach three different cities within a two years of entering China, and gave them the finances to set up shop in highly sought-after busy city locations.

Acquired premium segment of the market: Whether planned or a stroke of luck, Starbucks was exactly what people were looking for in the 1999s. China’s consumer culture was beginning to mature, and consumers had more money than ever to spend, and were looking for things to distinguish themselves from the crowd. So when coffee is marketed as “premium and for the high-income class”, it gives Chinese consumers a reason to try it out, over the more prominent tea.

Showing they care for their employees: Chinese workers are often provide more blood, sweat and tears than any other work culture in the developed world. This was prevalent in the 2000s, where ripples of the Mao era were still present in China’s working class. Having a job was a ticket to a greater life, one that was only dreamt of only a few decades ago. Unfortunately, the caveat was less wages and benefits for workers, as there would always be a dozen more people waiting to take the place of anybody that was dissatisfied. Starbucks sought to change this, differentiating their workplace culture. Better wages, free meals, and generous insurance coverage made employees feel respected. And people knew this, which served to help Starbucks gain popularity and trust.

Freshippo: The King of Retail in China

While it’s not fair to use the Alibaba-owned Freshippo as an example, considering they are a local retailer, it’s helpful to look at them as they (Alibaba) are one of the biggest companies in China, and have years of experience knowing how to conquer their local market. As such, their retailer Freshippo should be a source of inspiration, and a guideline for improvement.

In-depth breakdown

Alibaba-owned Freshippo (known as Hema Xiansheng in China) was launched in 2016, and considered one of the most successful Chinese retail chains. It drew consumers in by completely reinventing the in-store buying experience. It is the embodiment of “New Retail”—the term Alibaba founder Jack Ma coined to describe the full integration of online and offline retail to create the ultimate shopping experience. Freshippo in short, is light years ahead of Western retailers — here’s why.

Freshippo’s focus is on fresh food (as the name suggests), with huge displays of fresh meat, fruit and live seafood available for shoppers to browse and choose from in the store. The experience is distinctly culturally Chinese, designed to resemble traditional “wet markets” that sell fresh meat, fish, produce and other perishable goods. Freshippo recreates this experience with added digital convenience: shoppers can use the store’s app to scan goods and find out information about reviews, coupons, product origins and pricing, among other things, Furthermore, shoppers are able to use the same Alibaba login credentials that shoppers use for other Alibaba services, such as its Tmall and Taobao marketplaces. That makes making sign-up very easy.

Shoppers can also shop in different ways: Buy at the store and take the products home with them, buy at the store and have the products delivered to their homes, or buy at home from the Freshippo app and get the product delivered. Freshippo delivers products in just 30 minutes to shoppers.

On top of this, thanks to the deeply connected vast ecosystem of China’s social media, Freshippo and other retailers are able to collect and analyse data, helping them refine their strategy and create new and exciting campaigns and sales personalised for their shoppers.

How did Freshippo succeed?

Lifestyle fit and convenience: Freshippo uses QR codes so that shopping with their app or at their store seamlessly fits into the lifestyle of their consumers, and their habit of paying by tapping with their phone. Being able to login with credentials that work for all of Alibaba’s services means that shoppers waste minimal time setting their app up, and instead can get to buying things right away. As mentioned with Amazon, access, convenience, and speed trump everything — and Freshippo offers all that, and more.

Transparency in produce: Similar to Nong Fu Spring, Freshippo encourages and allows their customers to find out all the information they want to know (be it product origins, coupons, reviews etc.) about the products they buy. This builds transparency, and confidence, and also lets customers know what they’re buying from Freshippo will be of high standard.

Personalised shopping: Freshippo is able to offer personalised experiences for shoppers by anticipating consumer needs and interests. This type of personalised shopping is common in China. For example, Tmall has just unveiled its 2.0 flagship online store where every feature, product recommendation and piece of content on the page is customized for the individual shopper. No two Tmall pages or shopping experiences are the same. This hasn’t yet caught on in the West, and so brands that apply this will surely have an advantage.

Get Started Now

Whether you’re a start-up looking to kickstart your Chinese social media, a mid-sized company looking for KOL partnerships, or a multinational looking for cultural insights and an extensive Chinese marketing campaign, Vantage Digital can help. We deliver value and measurable results through quality marketing strategies and strategic thinking.

What’s more, we’re so easy to partner with. In fact, collaboration is something we truly pride ourselves on. We can help any brand get started on their journey, and be with them every step of the way. So the question is, are you ready to take your Chinese marketing to the next level?