What is Cross-Border E-Commerce?

Cross border e-commerce (CBEC) is the buying and selling of overseas products through e-commerce platforms. CBEC refers to online trade between a business and a consumer (B2C) e.g. Tmall, between two businesses (B2B), or between two consumers (C2C), e.g. EBay or Taobao. We will be looking at B2C cross-border e-commerce, along with how brands can access China’s enormous e-commerce ecosystem.

CBEC grants brands small and large an opportunity to scale their business globally, therefore it allows businesses to sell consumers from any country,.

What makes Chinese CBEC Special?

Australian businesses tapping into the Chinese CBEC market will immediately afford access to over 800 million potential shoppers. Moreover, the same shoppers who spent over US$500 billion entirely online in 2016. As Jack Ma, CEO of Alibaba has stated, “In other countries, e-commerce is a way to shop. In China, it’s a lifestyle”.

Cross-border e-commerce reached 8.8 trillion yuan (US$1.2 trillion) in 2018, and accounted for well over 20% of all of China’s foreign trade that year.

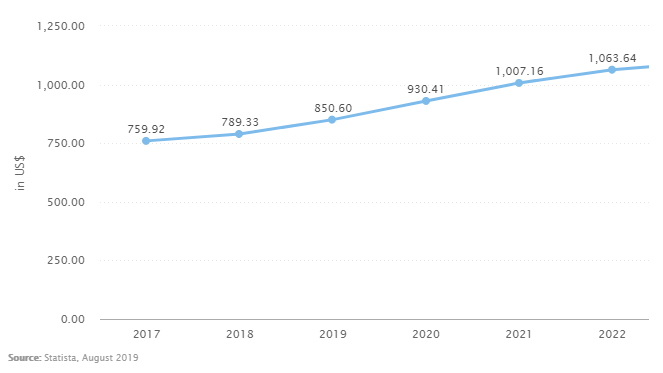

According to Statistica, the number of China’s online e-commerce users hit 850 million as of August 2019. This is over 80% of China’s total online population. In addition, these users are spending an average of $850 per year, and is expected to grow to $1007 by 2021.

Important Targets for Chinese Cross-Border E-Commerce

Cross-border e-commerce is most prominent in China’s larger cities. These include Shanghai, Beijing, Hangzhou, Guangzhou, and Shenzhen.

The top 5 countries that export to China are Japan, the USA, South Korea, Germany and Australia. Japanese and Korean exports are made up of mostly cosmetics and serums, while Western countries are more popular for baby products, food, and vitamins/supplements.

Cosmetics and baby products are the most popular among buyers overall. These products can be found outside of China, and manufactured in significantly higher quality, as a result this has improved their popularity among Chinese consumers with money to spend..

Overview of Cross-Border E-Commerce Platforms

Kaola.com

The largest platform for white-collar consumers in China’s Cross-Border E-Commerce Market

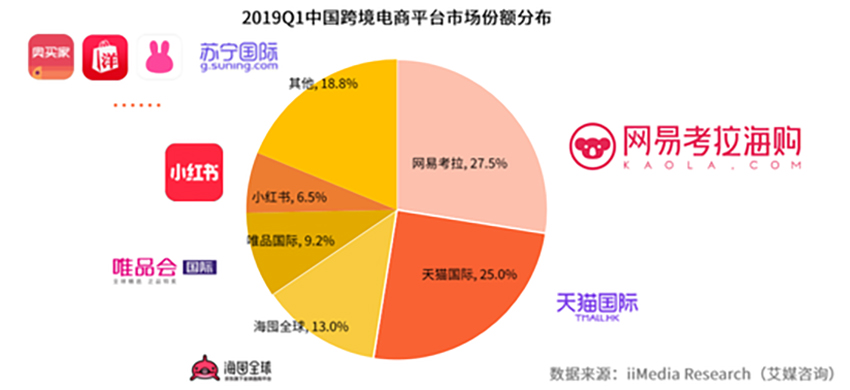

Kaola (owned by NetEase), is one of the largest platforms for Chinese CBEC. In spite of it only having about 30 million monthly active users, Kaola boasts the largest total market share within the cross-border e-commerce market (27.5% as of 2019 Q1).

Kaola does not have the highest user count, but it makes up for this through users being willing to spend more often on larger purchases. Kaola reinforces this point through its most prominent demographic, which is professionals aged 20-45, with high buying power seeking quality, authentic brands.

Major categories are mother and baby, apparel, sports and outdoor, accessories, personal care, food and beverage, nutrition and health.

Kaola CEO Lily Lei Zhang says: “As Chinese consumers become increasingly sophisticated, their focus has shifted from pricing concerns to a search for high-quality and reliable brands, as well as an enhanced and tailored user experience.”

Kaola also places emphasis on the convenience of their services. NetEase spokeswoman Maggie Liu said the koala was chosen as a symbol because, like the marsupial, NetEase wants its online customers to be “lazy and comfortable while it does all the hard work of delivering the best foreign products to people’s doors”.

Kaola.com was originally a platform for selling Australian products in China. However by 2019, E-retailers from over 80 countries sell through Kaola. In addition, with NetEase’s resources in news and gaming, Kaola is able to consistently drive user count up.

Users can purchase anything from diapers and baby formula to rock lobsters. Kaola is leading in the CBEC market due to its accessibility, quality assurance and variety of uses. Kaola also contains a community forum section named “种草社区 (zhong cao she qu)”, which allows users to share advice, feedback and reviews on products.

XiaoHongShu (Little Red Book)

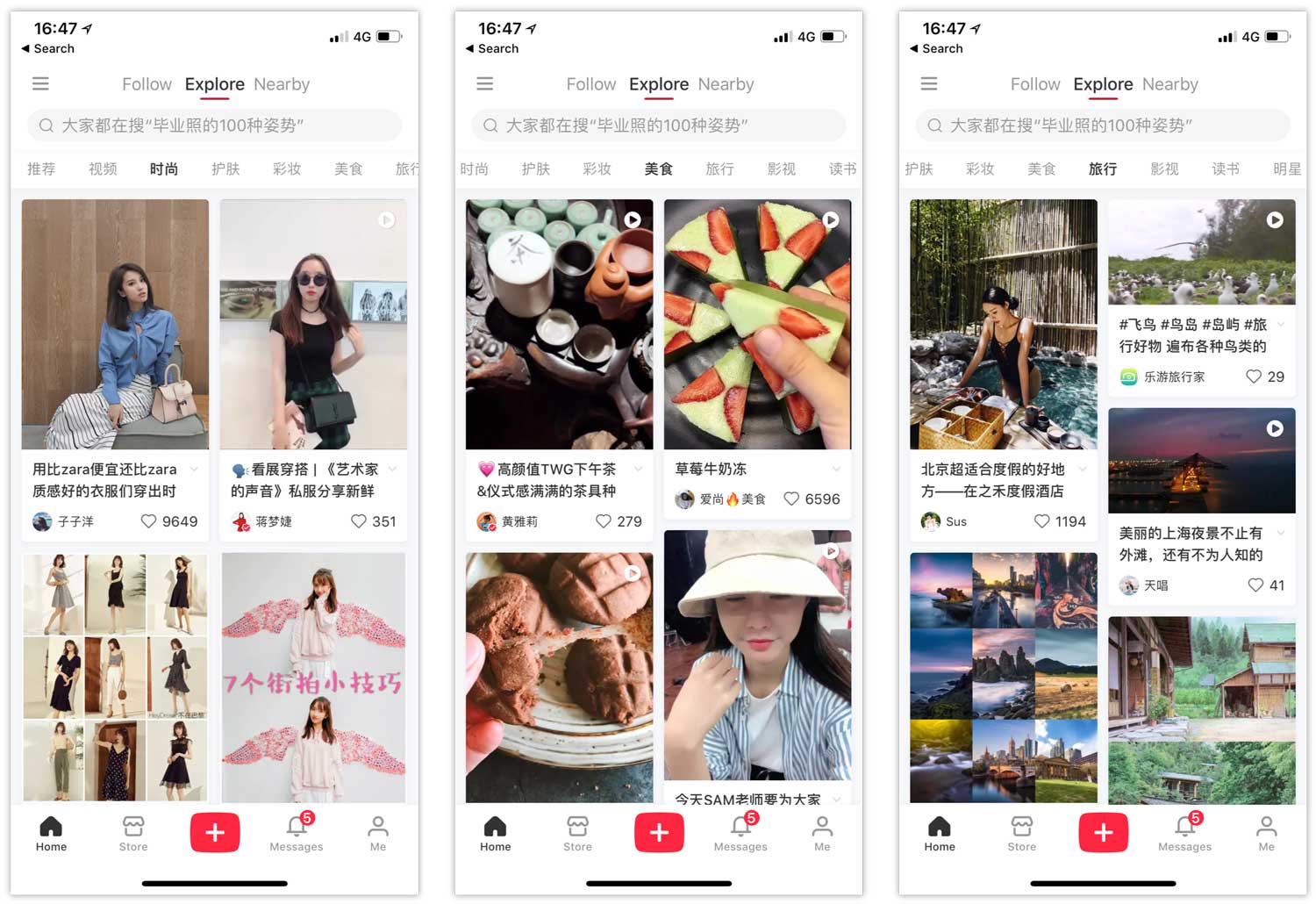

Hybrid social media app and E-Commerce platform, taking cross-border e-commerce integration to the next level

XiaoHongShu (Little Red Book) is a Chinese lifestyle sharing platform launched in January 2014, and has a monthly active user base of over 85 million. Little Red Book is both a social media platform and an e-commerce platform. It allows users to post pictures of their favorite products, which others can in turn purchase directly if they wish. As a result, it has become one of the most influential cross-border e-commerce platform.

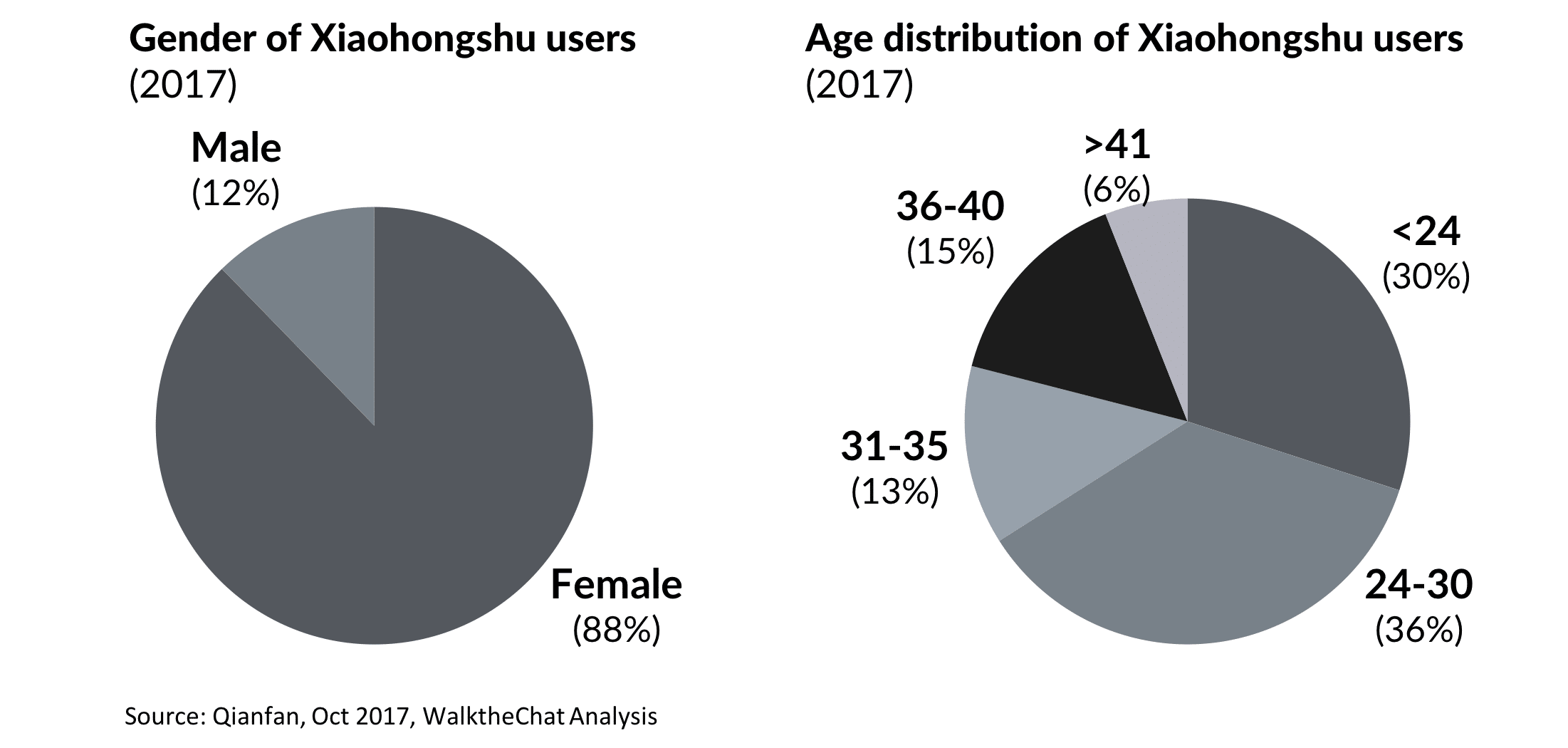

Little Red Book has seen incredible growth over the past several years, as it reached over 200 million registered users in January 2019. it’s monthly active users doubled between the end of 2017 and the middle of 2018, reaching 30 million. The platform is predominantly used by females 30 or younger, and its most popular product category is cosmetics.

Little Red Book offers low startup costs, a simple startup procedure, and connects with bigger e-commerce platforms like Taobao — Little Red Book posts can appear in the reviews sections of a product on Taobao.

Little Red Book also educates users on how to shop while traveling abroad. For example, popular user generated content includes shopping guides, and users documenting different shops and the products they buy. Brands on Little Red Book can be mentioned by users through @ (brand name) in posts, and consequently gain brand visibility, and opportunities for follower interaction.

Tmall Global

Provides international brands a streamlined opportunity to tap into the gargantuan Chinese e-commerce ecosystem

Tmall Global was launched by Alibaba Group, and it streamlines the entire B2C process for international brands. Tmall Global launched in 2014, and provides all the quality and authenticity that Tmall does. Above all else, Tmall Global helps circumvent the entry barriers presented by Tmall (requires foreign businesses to have a physical warehouse in mainland China).

Tmall Global affords international businesses the opportunity to tap into the very profitable Chinese market without the time, money and legalities that had been holding them back. Tmall Global has been used by over 20,000 international brands across 77 countries and regions.

Its demographics are similar to Little Red Book, with female shoppers being the most active and abundant. Age-wise, the majority of Tmall Global users are young, ranging between 16 and 28. Tmall Global shoppers typically look to buy products in two categories: Fashion (handbags, luggage and women’s apparel & shoes) and Personal Care (beauty products, cosmetics, non-perishable nutritional supplements and baby food).

Recently in June 2019, the company launched an English site for merchants, stating they are hoping within the next three years to double the number of international brands (to 40,000) on the platform. “We believe the launch of this English-language website will expedite the process for brands and merchants to introduce their products to Chinese consumers,” said Yi Qian, deputy general manager at Tmall Global.

Five things to take away from ‘Your Guide to Cross-Border E-Commerce in China 2019‘

- Cross border e-commerce (CBEC) is the buying and selling of overseas products through e-commerce platforms.

- Australian businesses tapping into the Chinese CBEC market, will immediately afford access to over 800 million potential shoppers. As Jack Ma, CEO of Alibaba has stated, “In other countries, e-commerce is a way to shop. In China, it’s a lifestyle”.

- …majority of (e-commerce) shoppers are relatively young, the largest user segment is 25-34 year olds (48%).

- Cross-border e-commerce is more prominent in China’s larger cities. The top 5 cities were Shanghai, Beijing, Hangzhou, Guangzhou, and Shenzhen.

- Kaola, XiaoHongShu/Little Red Book and Tmall Global are three very reliable platforms: Kaola for it’s high income demographic, Little Red Book for it’s affordability, and Tmall Global for all the benefits of Tmall without requiring a physical presence in China.