History Behind Chinese Third-Party Payments

In order to understand China’s online third-party payment market, we need to take a step back. Prior to the launch of Alipay by Alibaba in 2004, only one percent of the Chinese population owned a credit card.

At this time, banks hadn’t developed a system to facilitate online transaction, and e-commerce was in it’s infancy. However, this changed with the creation of Alipay by Alibaba, the first Chinese third-party payment solution.

Convenience and trust have always been at the forefront of China’s cashless purchasing, lending to the reliance upon local payment solutions.

Importance of Chinese Third-Party Payment Solutions

China’s e-commerce is flourishing fifteen years later and is practically unrivaled. In a market with over 800 million shoppers, selecting a local payment solution is important for foreign businesses.

Chinese consumers generally aren’t accepting of Paypal and other international payment solutions. Instead, they opt for local payment solutions that have proven to be trustworthy and convenient to their way of life, like Alipay.

Many foreign companies fail before they even enter the Chinese market, because they don’t understand Chinese people’s reluctance to use payment methods like Paypal. Therefore, one of the key elements of building an e-commerce platform in China begins with choosing a local payment solution.

Overview of China’s Third-Party Online Payment Market

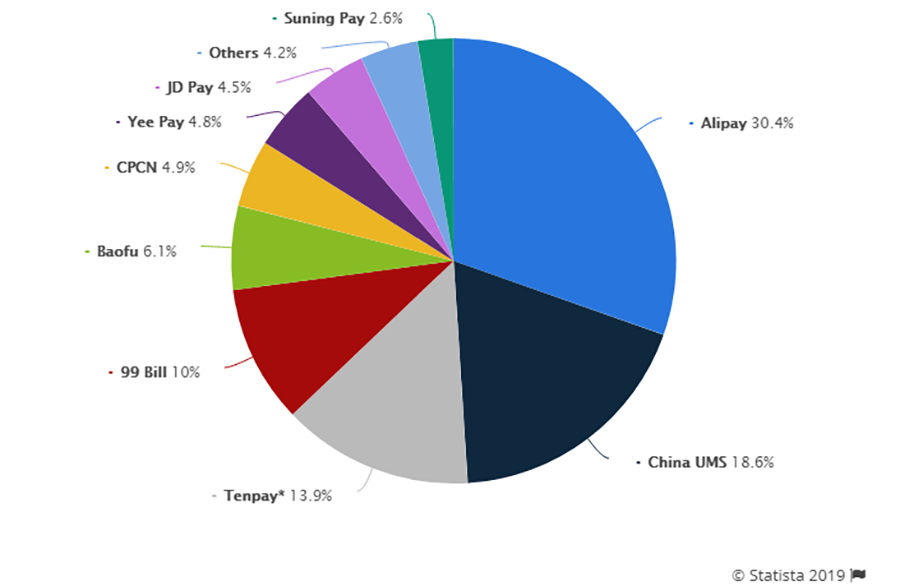

China’s third-party online payment transactions reached 29.1 trillion Yuan with a YoY growth of 3.6%. According to Statistica, the three platforms that made it to the top of China’s Third-Party Online Payment Market in 2018 are Alipay, UnionPay (UMS) and Tenpay with shares of 30.4%, 18.6% and 13.9% respectively.

Alipay and Tenpay both experienced similar positive growth YoY since 2017, from 28%-30.4% and 12%-13.9%. On the other hand, UnionPay saw a drastic decline from 27% to 18% as a result of smaller third-party payment services like 99 Bill, Baofu, and JD Pay becoming more popular

Alipay

The most commonly used third-party payment solution in China is AliPay. Over 180 financial institutions, 460,000 businesses, and acts as an electronic wallet.

The most commonly used third-party payment system in China is Alipay. They’ve operated with more than 180 financial institutions, including Visa and MasterCard — and more than 460,000 Chinese businesses. Alipay offers discount coupons, and the feeling of having a secure electronic wallet.

Tmall and Taobao, the two largest Chinese e-commerce platforms, only accept Alipay. It is also more secure than Tenpay since it is a standalone app, and not integrated into other apps.

Alipay is linked to a users bank account, allowing users to manage funds, transfer money to other users, make investments, take personal loans and pay for a range of services. Alipay supports over 14 major foreign currencies including USD, EUR, JPY, GBP, AUD, SGD, CHF, SEK, DKK, NOK, NZD, THB, HKD and more.

TenPay

Tencent’s online payment solution that is on track to rivaling Alipay. It seamlessly merges e-commerce with social media through WeChat and QQ integration.

TenPay is Tencent’s online payment system, which has over 200 million individual users and more than 400,000 enterprise users. Tenpay integrates social media with e-commerce, including powering the hugely popular WeChat Pay payment solution.

Chinese consumers use Tenpay to checkout at major cross-border e-commerce platforms like JD Worldwide. Because of its integration into WeChat and QQ apps (WeChat Wallet & QQ Wallet), it offers a very significant user database.

The most notable advantages according to users, is the convenience TenPay offers when it comes to peer-to-peer transfers. It is also hard to find anybody in China that does not use WeChat or QQ. Brands can link their WeChat Official Account to Tenpay, allowing customers to pay directly in the app, not unlike WeChat Pay.

Learn more about WeChat Pay, and its relationship with Tenpay and Alipay here.

Tenpay deducts the payment from the buyer’s account in real-time in CNY and settles the payment to your account in a chosen currency. Tenpay supports the following currencies: GBP, HKD, USD, JPY, CAD, AUD, EUR, NZD, KRW, THB, SGD, RUB.

UnionPay Online Payment

Connects brands and consumers in over 160 countries. Fast, secure, and widely used — Ideal for Chinese cross-border e-commerce.

UnionPay is one of the world’s leading payment card brands with over 6 billion cards issued worldwide.

UnionPay provides a payment solution called UnionPay Online Payments (UPOP) for their cardholders to use when making online purchases, a feature equivalent to Alipay or Tenpay. UPOP is China’s first financial-level pre-authorisation service for secured transactions. Their payment system allows payment for online shopping at any merchants that accept UnionPay, connecting brands and consumers in over 160 countries.

The UPOP cross-border payment service was launched as early as 2007. It carries out payment settlements within 1 to 3 days across the world. Furthermore, all the debit cards and the majority of credit cards issued in China belong to UnionPay, providing UnionPay with the broadest audience out of all three online Chinese payment services.

For businesses engaging in cross-border e-commerce, UnionPay is highly recommended. UnionPay supports EUR, USD, JPY and HKD.

Five things to take away from ‘Alipay, Tenpay and UnionPay: Guide to China’s Online Payment Market‘

- In a market with over 800 million shoppers, selecting a local payment solution is important for foreign businesses

- The top three third-party payment solutions are Alipay, UnionPay (UMS) and Tenpay with shares of 30.4%, 18.6% and 13.9% respectively.

- The most commonly used third-party payment system in China is Alipay. Used by more than 460,000 Chinese businesses. Alipay is a standalone app, meaning it is more secure than Tenpay.

- TenPay is Tencent’s online payment system, which has over 200 million individual users and more than 400,000 enterprise users. Brands can link their WeChat Official Account to Tenpay, allowing customers to pay directly in the app, not unlike WeChat Pay.

- UnionPay Online Pay connects brands and consumers in over 160 countries. It has the broadest audience out of all three online Chinese payment services. For businesses engaging in cross-border e-commerce, UnionPay is highly recommended.