Is China’s Economy Crashing?

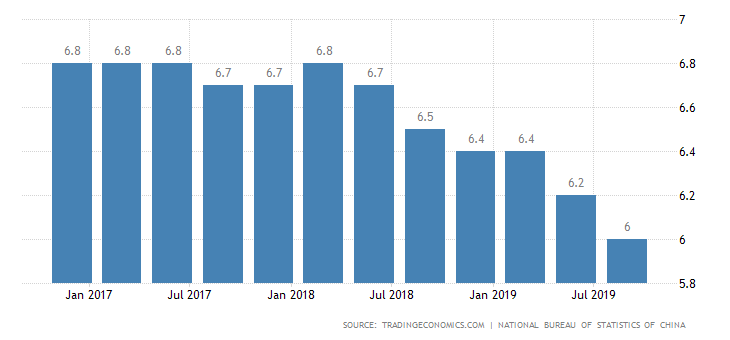

There has been significant buzz in recent months about the decline of China’s economic juggernaut. It’s hard to deny the evident cooling of GDP growth. This is the result of a rapidly aging population, a falling birth rate, a tightening Federal Reserve, and a slowing global economy. And some say that this spells the end for China’s economy.

This sounds frightening, and you may be ready to suspend your Chinese marketing strategy straight away — but hold that thought. Businesses (such as yourself) should be mostly unaffected. A quarterly research done by global market consultancy Nielsen indicates unchanged consumer confidence in China. What this means is that Chinese buyers remain positive in spite of the downward economic pressure, and are more ready to spend than ever.

Not convinced?

- During this year’s August 8 Shopping Festival, which ran from July 18 to August 8, Walmart’s stores in China set a new sales record, with sales up by a staggering 120% year-on-year.

- LVMH’s shares hit a record high in 2019 thanks to increasing demand for luxury goods in China. Michael Burke, Chairman and CEO of Louis Vuitton, says that demand for Vuitton products within mainland China was still at “unheard of” levels.

- For the first half of 2019, Chinese tourists reportedly spent $128 billion overseas despite US trade protectionism.

- During the recent Golden Week (from October 1-7), retail and catering businesses in China saw sales of $213 billion, up 8.5% on the same period last year.

So the truth of the matter is, China’s economy is not crashing, it is simply slowing down.

With that out of the way, join us as we analyse the slowdown of China’s economy in-depth, to gain a better understanding of the story behind the numbers — and how it may impact your business.

China’s GDP Weakened But Still Substantial

China’s economic activity has been weakened considerably thanks to the trade war and various internal influences. As of Q3 2019, China’s GDP growth has slowed to 6%, the lowest in three decades. At a glance, this sounds poor — but let’s take a closer look.

Firstly, 6% albeit low, is still in line with the China’s annual target range of 6.0-6.5% for the year.

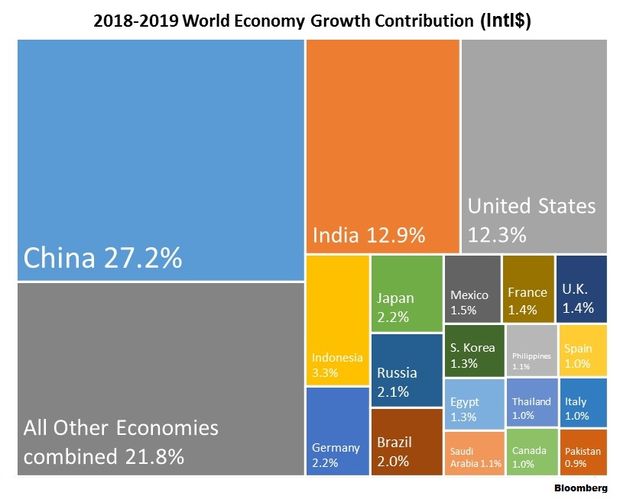

Furthermore, China continues to rack up one of the fastest rates of economic growth in the world.

In a vacuum, 6% would actually be incredibly high for any country, with most countries (including the US, UK, Australia, Brazil, Germany to name a few) seeing less than 2.5% growth per year. And then thanks to China’s enormous scale to begin with, 6% turns into a substantial addition that overshadows growth seen nearly anywhere in the world. It will equate to the equivalent of China adding the entire Australian economy to its GDP.

This level of massive growth can be seen in 2018 as well, where China’s GDP growth was 6.6% for the year (also at a decline from the prior year), but still eclipsed those of the G7 economies, accounting for around 30% of the worldwide increase in GDP.

The Chinese Economy – Good or Bad?

With the escalation of the US-China trade war, a wave of concern has been triggered over the strength of China’s consumer engine.

And while manufacturing activity, industrial profits, car sales, exports and gross domestic product growth have no doubt been impacted due to the trade war, it doesn’t tell the whole story.

Taking a Deeper Look

To begin, China’s online sales surged 17.8% year-on-year to 4.82 trillion yuan in the first half of 2019, indicating that the popularity and prevalence of e-commerce platforms such as Tmall and Little Red Book is going strong.

China’s growth in its service sector and consumption has also continued on a positive trend from 2018.

- China’s service sector accounted for 54.9 per cent of the total GDP, rose 7% in the first half of the year, outpacing a 3% increase in the primary industry and a 5.8% rise in the secondary industry.

- Consumption appeared to play a bigger role in driving economic growth as it contributed 60.5% to China’s GDP in the first three quarters.

Not to mention, in 2018, China created 13.6 million new urban jobs, exceeding its 11 million target. For 2019, it appears that China is set to accomplish the same; in the first half of the year, 7.73 million new jobs were created in urban areas, completing 67% of the annual 2019 target.

New Purchasing Behaviours

Putting aside good or bad, these changes in China’s consumption patterns have led to some new purchasing behaviours. For the first time in China, we see a new segment of customers trading down.

The success of Pinduoduo, a lower segment discounter appealing to customers trading down—and which has disrupted China’s e-commerce duopoly—indicates a maturing and changing market.

China’s Consumer Engine Going Strong

China Consumer Trend Index

As mentioned earlier, China’s economy may have slowed, but business prospects is still flourishing as consumers remain willing to spend. This is shown in China’s Consumer Trend Index released by Nielsen for the first half of this year.

Consumer Trend levels above and below a baseline of 100 indicates degrees of optimism and pessimism, respectively.

- Readings from Nielsen’s report shows Chinese consumer confidence has remained high in the second quarter of 2019.

- The Consumer Index maintained a reading of 115 from Q1, indicating Chinese consumers are optimistic regarding local job prospects, personal finance and willingness to spend

According to consensus forecasts, Chinese consumption is expected to grow by about $6 trillion from today through 2030. This enormous sum is equivalent to the combined consumption growth expected in the US and Western Europe over the same period; and double that of India and ASEAN economies combined.

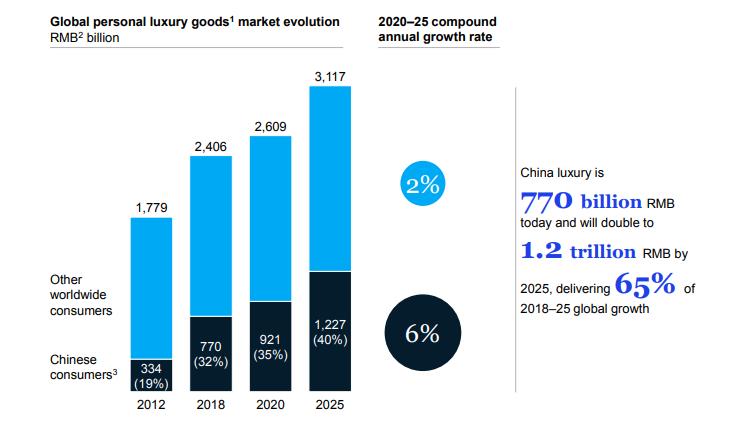

Luxury Consumption

Just like consumer spending, China’s luxury segment remains robust even in the face of the sharpest slowdown in China’s economy since the financial crisis, with Chinese affluents increasing their spending on high-end goods.

While some luxury brands have posted discouraging results over the past year, there are also just as many on the contrary, including: Estée Lauder, Hermès, Kering, Richemont (owner of Cartier), and LVMH (Louis Vuitton) — whose shares and revenue hit record highs, as demand for its handbags and high-end fashion picked up in mainland China.

In the bigger picture, McKinsey predicts China to become the largest engine of luxury consumption by 2025, according to their 2019 China Luxury Report.

- China accounts for over 50% of global growth in luxury spending from 2012-2018, and is expected to contribute 65% by 2025.

- In 2018, Chinese consumers both in the mainland and abroad, spent 770 billion RMB ($115 billion) on luxury goods, or one-third of total global luxury goods spending.

- Their 2018 figure is expected to nearly double to 1.2 trillion yuan ($178 billion) by 2025, representing 40% of the world’s total luxury goods consumption.

This impressive growth will be super-powered by the next generations of customers in China: Millennials and Gen Zers. “Luxury consumers [in China] are very young,” says Nicolas de Bellefonds, partner and managing director at BCG France. “48 percent of them are aged under 30 but contribute to 42 percent of luxury sales.”

What we can gather from this, is that in the coming years, China will see the growing prevalence of a new kind of young consumer: one who will redefine and escalate the prosperity of the Chinese luxury market. With new buyers and purchasing behaviours, brands will need to learn and adapt quickly in order to stay relevant in China.

Marketing and Engaging

“Luxury brands should take the current ‘crisis’ as an opportunity to innovate their mobile-commerce capabilities on Little Red Book and WeChat into truly global online-to-offline shopping experiences that capture Chinese consumers whenever they shop – inside of China or in hot destinations such as Italy and Spain,” says Renee Hartmann, co-founder of China Luxury Advisors.

When e-commerce is paired with other digital marketing strategies like KOL marketing and social media, it can yield returns in the millions — and this fact has not changed in spite of everything that is going on.

- During Tod’s 2018 collaboration with Chinese influencer Mr Bags on WeChat, they generated 3.24 million RMB ($460,000) within 6 minutes—beating the Chinese handbag guru’s own record of selling out in 12 minutes during his collaboration with Givenchy in 2017.

- Earlier this year, Tod’s partnered with Mr Bags once again, unveiling its 2019 Summer limited edition “Unicorn D Styling” bag (roughly priced at $2,175). Since the launch, Mr. Bags’ online store and Tod’s mainland boutiques all sold out, garnering approximately 4.77 million RMB ($696,000).

- Cosmetics brand M.A.C partnered with Tencent’s mobile game “Honor of Kings”, to release five limited-edition lipsticks. Celebrities from a reality show were also recruited to promote the campaign. The mash-up was an overwhelming success, with over 14,000 pre-orders across the three platforms. All five lipstick styles sold out across all sales channels within 24 hours of the launch.

- A more recent example is Secoo’s collaboration with Chinese fashion blogger Becky Li, in which they offered a selection of luxury bags, clothes and shoes from over 100 brands. With an ingenius use of QR codes and a WeChat Mini-Program, Secoo amassed a staggering 20 million RMB ($2.9 million) in sales within 15 days.

These examples are clear indicators of the prosperity and value that China can provide for businesses. So regardless of the outcome of the US-China trade war and other factors, China will remain king, no two ways about it — and understanding how to remain relevant will be key going forward.

Long-Term Opportunities For Brands Willing to Step Up

“As China’s supply-side structural reform deepens along with policies to ensure the stability of employment, the financial sector, foreign trade, foreign and domestic investments, the country’s economic structure has constantly improved and the endogenous power of its economy has kept growing,” Justin Sargent, president of Nielsen China, said.

This highlights the resilience and vitality of the Chinese economy, and effectively promotes the country’s long-term stable development in spite of growing conflicts with the US.

For many companies, the question is whether they can adapt quickly enough to slower growth, or whether their strategies, balance sheets, and operations require higher growth to thrive, or even survive.

Get Started Now

Ironically, just as headlines about China become less exuberant, now might be precisely the time to more purposefully step up presence and engagement.

So whether you’re a start-up looking to kickstart your Chinese social media, a mid-sized company looking for KOL partnerships, or a multinational looking for cultural insights and an extensive Chinese marketing campaign, Vantage Digital can help. We deliver value and measurable results through quality marketing strategies and strategic thinking.

What’s more, we’re so easy to partner with. In fact, collaboration is something we truly pride ourselves on. We can help any brand get started on their journey, and be with them every step of the way. So the question is, are you ready to take your Chinese marketing to the next level?